-

Steel Dragons

The UK steel industry is in crisis, and the root cause is global trade. My BBC radio programme on the Port Talbot catastrophe, and why it matters to everyone in the UK.

-

Extreme Economies

Nine countries, over 500 interviews and 100,000 miles of travel. Extreme economies won the Lonely Planet debut travel writing prize.

-

Chart Library

A library of chart types, together with code needed to draw them in a live website. Includes examples used in my data science courses.

-

Data Science

A step by step guide to the Data Science course that I have developed alongside colleagues in the Economics Observatory Data Team.

-

Declining Dynamism

The UK’s productivity slowdown is the nation’s foundational economic challenge. Stalling dynamism is a root cause. A page housing my research into this problem.

-

100 days to kickstart Britain

An economics discussion at the LSE, featuring Soumaya Keynes, Eshe Nelson, Sam Richards, Danny Sriskandarajah. How can we kick-start British productivity?

-

45 million UK prices

A page housing UK CPI microdata and related research. These datasets are useful for reserch into inflation, inequality, real wages, trade and business cycles. I update this monthly.

-

Debt, demographics and devolution

A piece explaining why the mix of falling birthrates, rising localised debt and stronger devolution will be a key risk for 2025-2030,

-

Auto CPI

AI can be used to collect, clean and summarise price data. Our automated food CPI is quick to build, has broad coverage and is low cost. It could complement official statistics.

-

Economics for Everyone

A new course for people who have never studied economics, but have big economic questions they would like to answer. This is Economics for Everyone.

-

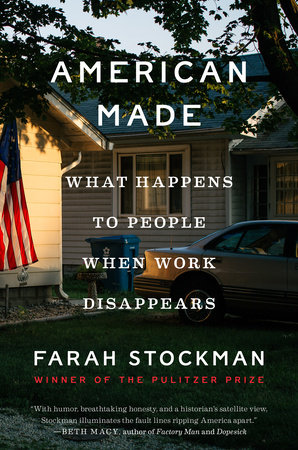

American Made

The result of three years’ worth of interviews and on-the-ground reporting, American Made is a reminder that journalism is a vital tool in uncovering how economies truly function.

-

The Hidden Economy

The hidden economy is larger and more sophisticated that we imagine. It is an essential element of economic resilieince.

-

The Chicago Boys

An account of inequlaity in Chile, and the role that a group of policymakers known as the “Chicago Boys” played.

-

Glasgow: A City’s Demise

Glasgow went from being the most succesful in Europe to one of the most troubled as it’s shipbuilding industry failed. A warning from Scotland.

-

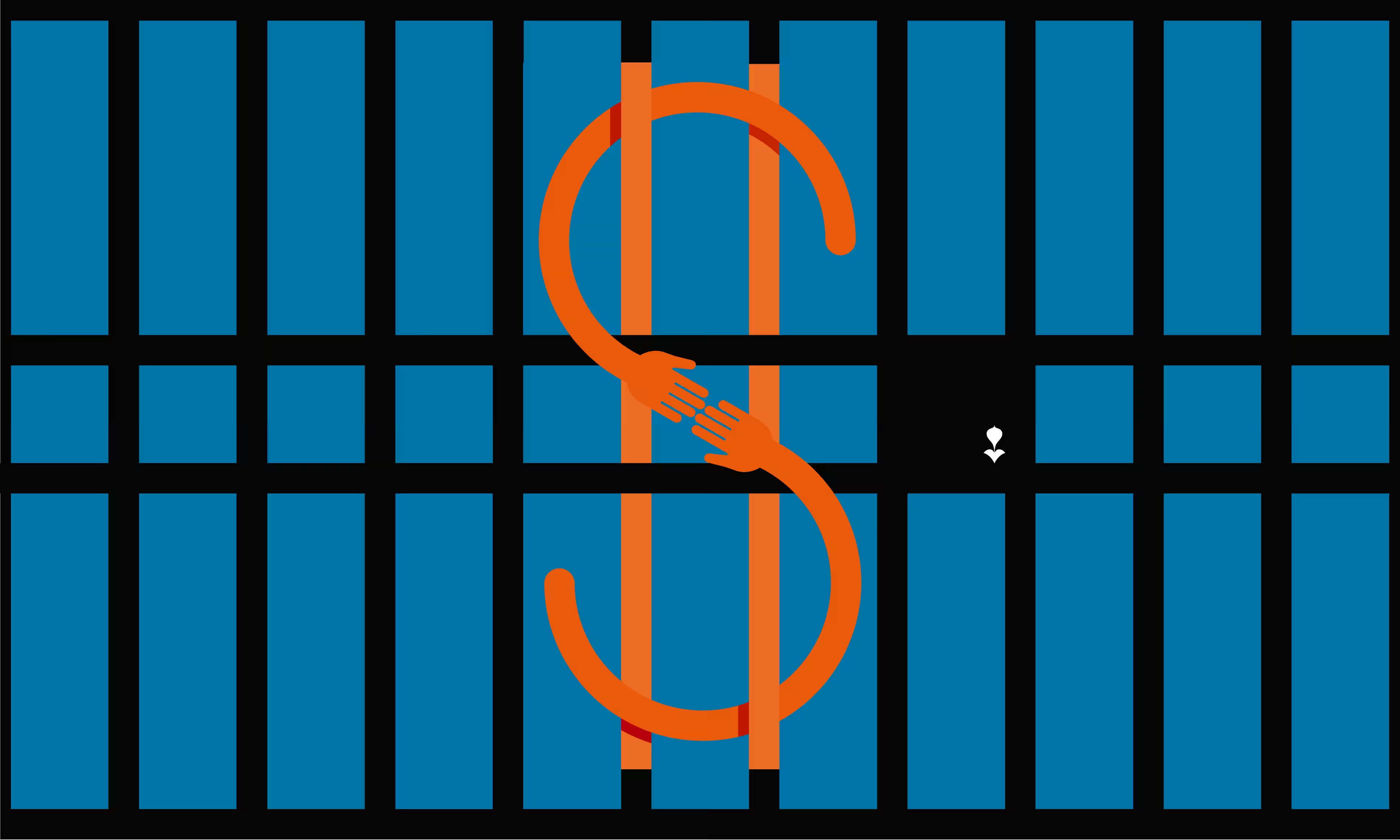

Prison Currencies

From pecan pralines to ‘dots’ as currency: how the prison economy works. My trip to the largest maximum security penetentiary in the US.

-

Why pyramid schemes are on the rise

Pyramid schemes are becoming more common, made easier by social media. They often target women, and religious groups.

-

Inheritance and incentives

Should you leave your children all your wealth, or cut them out altogether? Lessons on inheritance and incentives from Andrew Carnegie and Warren Buffet.

-

Brazil: The crash of a titan

The fall of Brazil’s economy and the role that poor policy decisions have played.

-

Britain: How is it really doing?

A warning: Britain is on a path of low investment, poor productivity and weak wage growth.

-

The King of Con Men

The tale of Gregor MacGregor, the mastermind behind the biggest financial swindle in history – the magical land of Poyais.

-

Stars of Microeconomics

How microeconomists working inside tech firms are using their academic findings to improve the way markets work.

-

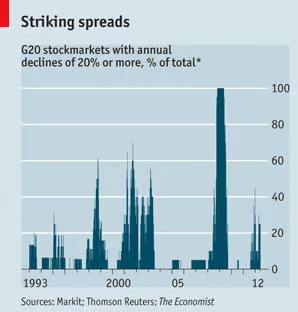

Economic epidemiology

The Greek crisis raises concerns about contagion to other economies. Can economics help us predict which country might be hit next?